Does your financial life need to be better organized? Do you dread tax season and wonder how to save more money? There are a lot of moving parts to a person’s financial puzzle, including wills, trusts, savings accounts, investments, monthly budgets, insurance premiums, car payments, mortgages and more. Fortunately, there are good ways to keep everything in line and running smoothly. Technology can work for us, if we know how to use it at the right time and in the right way. Here are some of the better trends in the world of consumer finance. In most cases, each passing year brings newer, more sophisticated versions of each one.

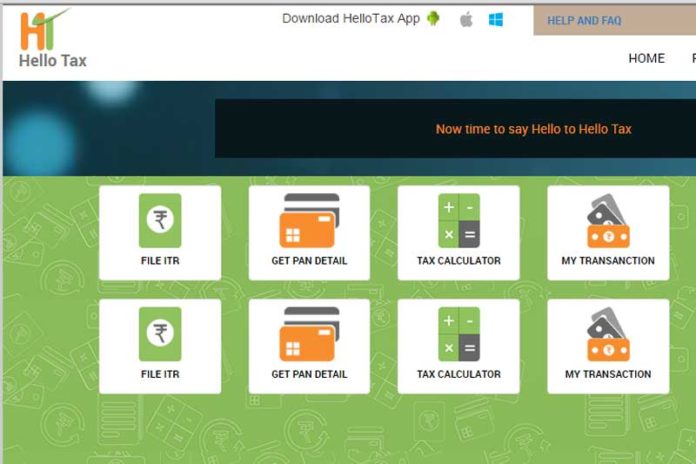

Tax Apps

Applications for personal income tax preparation have been around for decades. Only recently, however, have they become seamlessly powerful and reasonably priced. No longer do individuals need to bring all their paperwork to a tax professional. After downloading a tax app, you can fill out your return in less than an hour from the comfort of your home. If you need additional help, most of the apps include a phone or email contact for an extra charge. Unless you have a complex return that includes business income and high-end investments, you can usually use one of the free, online tax programs and electronically submit both state and federal documents directly to the IRS.

Also read: SBA Loans: Benefits and Application Procedure

Smart Spreadsheets

What can the new breed of smart spreadsheets do? Plenty. For example, if you decide to save money by refinancing student loans to lower your monthly expenses, the sheet can configure your new monthly payment amounts, updated interest charges and show you a timeline for repayment under the refinanced contract. Many consumers refinance their education debt and home mortgages to save money. The math can get tricky when you try to envision all the possible scenarios, which is why smart spreadsheets are so convenient.

Automatic Savings

There are dozens of apps on the market that help you save money by making the task nearly invisible. For example, if one of the more popular products deducts one-half of one percent of all bank deposits you make and places the money into a high-interest savings account. Most consumers never notice the half-percent and are surprised to see how much cash they have socked away at year’s end. You can download most of the automatic savings applications for free.

Robo Advisors

Robo advisors are one of the newest wrinkles in the world of stock investing. These high-tech apps that use enhanced AI algorithms help investors rebalance portfolios, choose stocks based on pre-set criteria, diversify all buys and more. There are small fees for using the robos, but compared to what full-commission brokers charge, the expense is negligible.

DIY Wills and Trusts

In the age of do-it-yourself everything, this trend was bound to happen. DIY wills and trusts are one of the latest offerings from online legal platforms where just about anyone can create a valid will or trust document, ask questions along the way, and print the final version out for safekeeping. Most of the services advise consumers to double-check everything with a real attorney, just to be on the safe side.

Also read: Tech and Teens: 5 Gadgets Teens Love Using